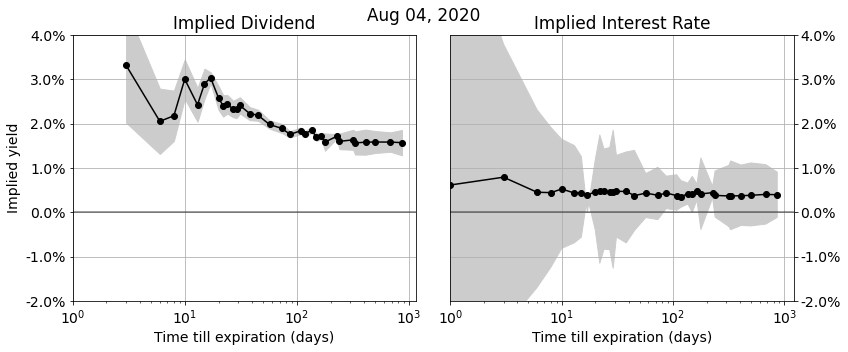

In this post we discuss the algorithms we use to accurately recover implied dividend and interest rates from option markets.

Implied dividends and interest rates show up in a wide variety of applications:

- to link future-, call-, and put-prices together in a consistent market view

- de-noise market (closing) prices of options and futures and stabilize PnL’s of option books

- give tighter true bid-ask spreads based on parity and arbitrage relationships

- compute accurate implied volatility smiles and surfaces

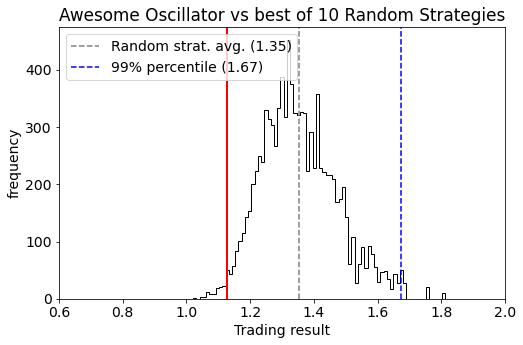

- provide predictive models and trading strategies with signals based on implied dividends, and implied interest rate information